Contributors: Andrew Walker, Bruce Ensrud, Matt Stockman

PORTFOLIO MANAGEMENT UPDATES

Our Q1 2022 Market Commentary described how markets are currently digesting a regime shift as it relates to monetary and fiscal stimulus. While 2021 benefited from residual COVID-driven stimulus, additional fiscal stimulus efforts were stalled by moderate-democrats, and expectations of continued monetary stimulus were disrupted as inflationary pressures accelerated the Federal Reserve’s timeline for reducing monetary stimulus.

As markets have digested this tide-change in stimulus, we have seen a spike in volatility. Less fiscal stimulus means less money for consumers to spend and drive-up corporate profits. Likewise, less monetary stimulus makes borrowing more difficult and removes liquidity from the financial system. The Federal Reserve will be walking a fine line between tightening too slowly (and risk NOT reining in inflation) and tightening too quickly (and risk hurting the economy).

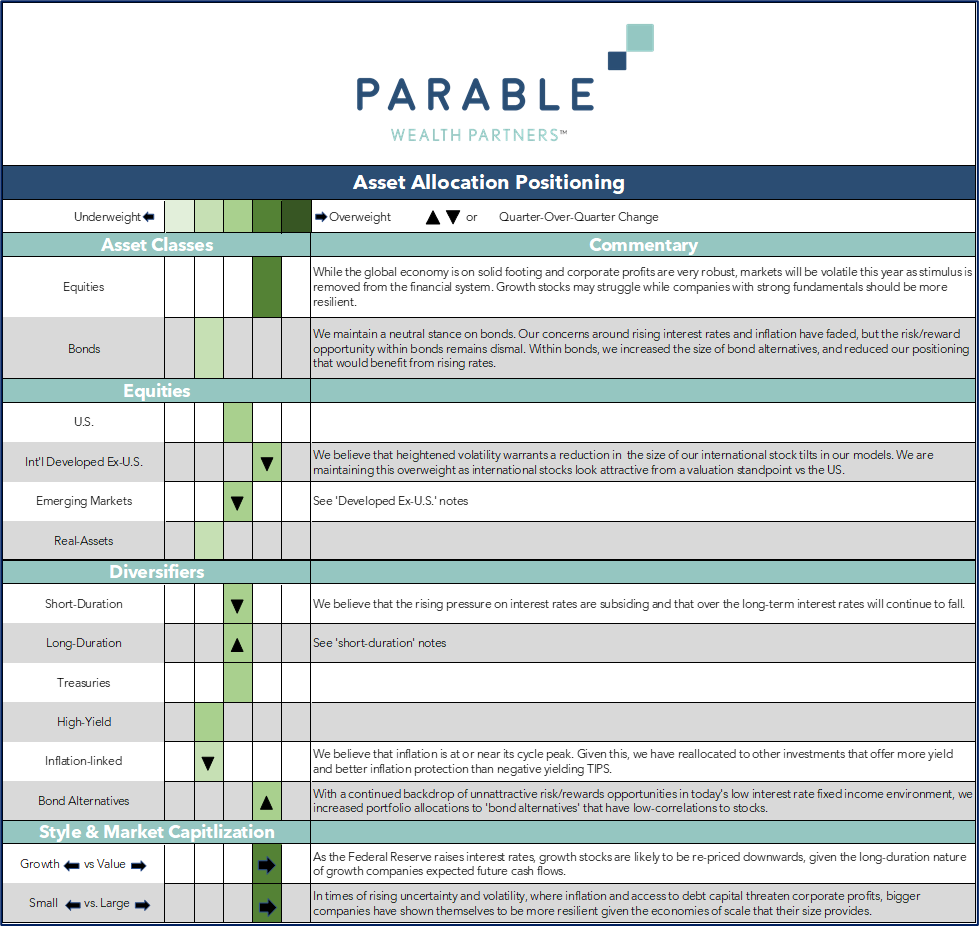

We believe that stimulus leaving the economy will cause investors to focus increasingly on fundamentals and valuation, rather than on speculation and growth. With this in mind, we have made several changes to our model portfolios. These changes are outlined below:

Reduce Size of Active Tilts

In an environment of heightened volatility, it is prudent to reduce the size of active tilts in portfolios. Given this, we reduced (but maintained) the size of our overweights to international value and US value. We are maintaining these overweights as the international value and US value stocks look attractive considering an expected increase in focus on fundamentals and valuation.

Increase US Large Cap; Decrease US Small Cap

In times of rising uncertainty and volatility, where inflation and access to debt capital threaten corporate profits, bigger companies have shown themselves to be more resilient given the economies of scale that their size provides.

Decrease Growth Equity Allocations

As the Federal Reserve raises interest rates, growth stocks are likely to be re-priced downwards, given the long-duration nature of growth companies’ future cash flows.

Increase Intermediate-Maturity Bonds; Decrease Short-Maturity Bonds

Our model overweight to short-maturity bonds has worked very well in the rising interest rate and inflationary environment of the past year. We have significantly reduced this overweight to a) take some gains off the table and to b) acknowledge that at some point existing long-term forces pushing rates down will limit further run-up in interest rates.

Reduce use of Treasury Inflation-Protected Securities as Inflation Hedge

Our Treasury Inflation-Protected Securities (TIPS) allocation has performed well over the last year, as inflation expectations have exceeded expectations. Generally, TIPS performance is a function of inflation expectations AND demand for inflation protection. We believe that inflation – as well as demand for inflation protection – is at or near its cycle peak. Given this, and the fact that TIPS have a negative yield to them, we have significantly reduced our allocation here in favor of core bonds (higher yielding) and real assets (a more prudent inflation hedge at this point in the cycle).

Increase Usage of ‘Bond Alternatives’

In the low interest rate environment that we continue to find ourselves in, it continues to be imperative to find bond alternatives that offer more attractive risk/reward profiles than bonds, while still maintaining low correlation to stocks. We have increased the size of this portion of portfolios as it continues to perform well in the current environment.

Beyond the above changes, we also took advantage of a few opportunities to increase our use of low-cost passive index funds within US Equity allocations, to drive down overall portfolio costs.

Thank you for allowing us to partner with you as we navigate the ever-changing market. We appreciate your continued trust.

If you have questions or would like to dive deeper into this quarter’s outlook, please reach out to our investment team. We’d be happy to set up a virtual coffee to talk more.

Parable Wealth

Advisory Persons of Thrivent provide advisory services under a practice name or “doing business as” name or may have their own legal business entities. However, advisory services are engaged exclusively through Thrivent Advisor Network, LLC, a registered investment adviser. Parable Wealth Partners and Thrivent Advisor Network, LLC are not affiliated companies. Information in this message is for the intended recipient[s] only. Please visit our website parablewealth.com for important disclosures.

Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable.

Asset allocation may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss. Performance of the asset allocation strategies depends on the underlying investments.

This website is intended to provide general information about Parable Wealth Partners and its services. It is not intended to offer or deliver investment advice in any way. Information regarding investment services are provided solely to gain an understanding of our investment philosophy, our strategies and to be able to contact us for further information.

Market data, articles and other content on this website are based on generally available information and are believed to be reliable. We do not guarantee the accuracy of the information contained in this website. The information is of a general nature and should not be construed as investment advice. Please remember that it remains your responsibility to advise Parable Wealth Partners, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services.

We will provide all prospective clients with a copy of our current Form ADV, Part 2A (“Disclosure Brochure”) and the Brochure Supplement for each advisory person supporting a particular client. You may obtain a copy of these disclosures on the SEC website at http://adviserinfo.sec.gov or you may Contact us at team@parablewealth.com to request a free copy via .pdf or hardcopy.