Incentive Stock Options (ISOs) Overview

By Ben Reynolds

Key Takeaways (Bottom Line Up Front):

- Both being Stock Options, ISOs and NQSOs are very similar. The key difference is taxation.

- ISOs are only valuable if the stock price exceeds the Exercise Price.

- ISOs have leverage, which creates risk, but also material upside potential.

What are ISOs?

Incentive Stock Options (ISOs) are a type of stock option granted to employees allowing them to purchase company stock at a fixed price, known as the Exercise Price. The number of shares available for purchase and the fixed price are specified in the award agreement.

Similar to Non-Qualified Stock Options (NQSOs), ISOs become valuable if the company stock price appreciates beyond the Exercise Price. If the stock price rises, the employee has the right to purchase the stock at the lower Exercise Price and sell it for a profit.

Conversely, ISOs have no value if the company stock price falls below the Exercise Price. In this case, it would be better for the employee to buy shares on the open market at the current Fair Market Value rather than exercising the ISOs.

The key difference between ISOs and NQSOs comes down to taxation. More on this later.

Key Terminology

Grant Date:

The date on which the ISOs are awarded to the employee. On this date, the employee will receive documentation confirming the award, the number of options, Exercise Price, Expiration Date, vesting details, and other relevant information.

Vesting/Vest Date:

The date when ISOs become eligible for exercise.

Vesting Schedule:

The time period over which ISOs vest. There are two common types of vesting schedules.

- Cliff Vesting: When the full award vests at one time.

- Graded Vesting: When a portion of the award vests incrementally over time. For example, 25% of the award vesting per year over 4 years – OR – 33% of the award vesting per year over 3 years.

Exercise:

The process of purchasing ISOs. Upon exercise, the ISOs simply become shares of company stock that the employee can retain or sell (subject to trade window restrictions).

Exercise Price:

This is the fixed price the employee can purchase the company stock at, regardless of the Fair Market Value on the date of exercise.

Sale Date:

The date when the employee chooses to sell the exercised shares, turning them from company stock into cash. From here, the employee has several options for allocating the sale proceeds (net of any corresponding tax liability). Considerations include retaining in cash savings, pay down debt, earmark for upcoming expenses, invest for growth, gift to charity, etc.

Qualifying Disposition:

This occurs when an employee sells shares purchased through an ISO grant after meeting both of the following conditions, which improves tax-efficiency of the sale.

- Shares are held for at least 1 year after the Purchase Date.

- Shares are held for at least 2 years after the Grant Date.

Disqualifying Disposition:

In short, this is anything that does not meet the two-part holding test outlined above in the Qualifying Disposition description. In this case, the full value at the Exercise Date is subject to Ordinary Income taxation. Any gain since the Exercise Date is subject to Capital Gains rate (Short Term Capital Gains rates if held for less than 1 year from the Exercise Date).

Expiration Date:

The date when the employee’s ability to purchase/exercise the shares expires. It’s important to be mindful of this date to avoid valuable (“In the Money”) ISOs expiring worthless.

ISO Example

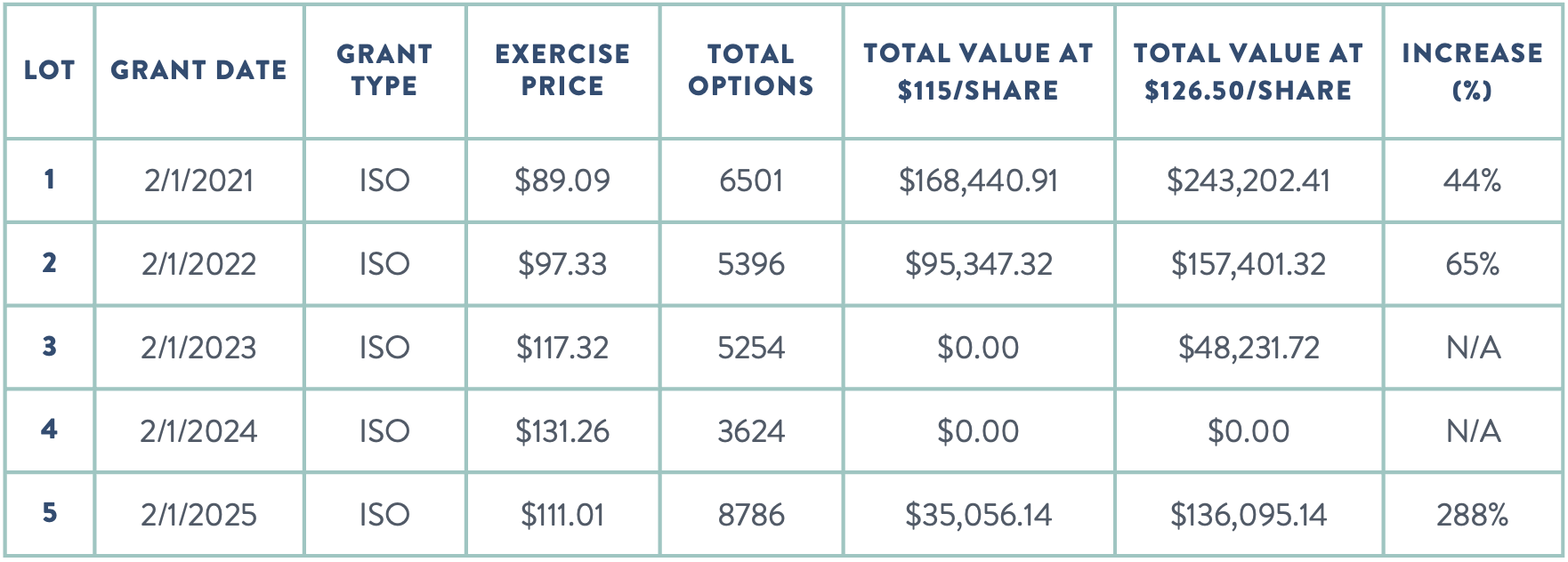

Let us explore an example of an employee’s hypothetical ISO stock option awards over multiple years, assuming the company’s stock is valued at $115/share:

Key Points

- How is “Total Value “Calculated?

- Formula: (Current Fair Market Value – Exercise Price) x Number of Options

- Looking at Lot 1: ($115.00 – $89.09) x 6501 = $168,440.91

- As you can see, the Lots where the $115/share Fair Market Value exceeds the Exercise Price (Lot 1, 2, & 5) have a positive “Total Value”.

- Conversely, the Lots where the $115/share Fair Market Value is lower than the Exercise Price (Lot 3 & 4) have no value.

- This hypothetical illuminates a core concept of ISOs: There is only value if the stock price is appreciated beyond the Exercise Price.

- Lastly, it is important to remember that ISOs are “Appreciation Only” awards. Using Lot 1 as an example, the employee’s value is simply the appreciation beyond the $89.09 Exercise Price ($115.00 – $89.09 = $25.91) multiplied by the number of Options (6501 options x $25.91 = $168.440.91).

Leverage

A key feature to understand is the concept of leverage, which is inherent in ISOs. Leverage means a small percentage increase in the stock price can result in a disproportionately larger increase in ISO value. Simply put, a 10% increase in the stock price will increase the value of ISO by more than 10%.

Expanding on the previous example, assume the Fair Market Value increases by 10% from $115.00/share to $126.50/share.

Key Points

- A 10% increase in the stock price resulted in:

- Lot 1 value increasing by 44%.

- Lot 2 value increasing by 65%.

- Lot 3 value moved from no value (“Out of the Money”) to having value (“In the Money”).

- Lot 4 still has no value; “Out of the Money”.

- Lot 5 value increasing by 288%.

- The closer the Exercise Price is to the Fair Market Value (smallest initial spread), the more embedded leverage. The Lot 5 example shows how a small initial spread between $111.01/share and $115/share means even a modest price increase creates a substantial percentage gain relative to the starting value.

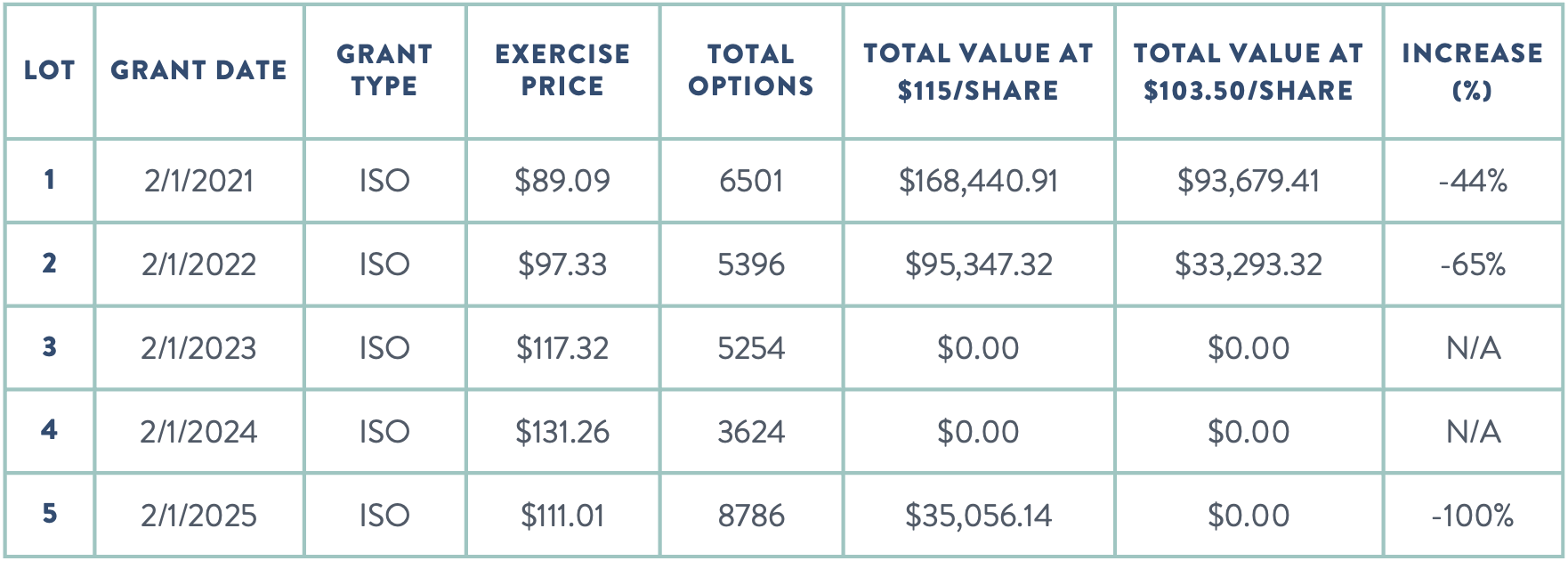

It is important to remember leverage works in both directions. Just as a stock price increase magnifies ISO value, a decrease in stock price magnifies the loss.

While the previous example highlighted how a 10% increase in the stock price will increase the value of ISOs by more than 10%, the inverse is also true. See below, which illustrates a 10% reduction in Fair Market Value from $115.00/share to $103.50/share.

Key Points

- A 10% decrease in the stock price resulted in:

- Lot 1 value decreasing by 44%.

- Lot 2 value decreasing by 65%.

- Lots 3 & 4 still have no value; “Out of the Money”.

- Lot 5 decreasing by 100% (no value).

- Therefore, it’s important to remember that leverage goes both ways.

ISO Taxation

Favorably, there is no taxable event at the Grant Date, Vest Date, nor the Exercise Date. The employee does not owe taxes until the shares are sold, assuming they meet the criteria for a Qualifying Disposition (definition above).

In the case of Qualifying Disposition, the employee can receive favorable Long Term Capital Gains treatment. Again the criteria to meeting the Qualifying Disposition threshold is

- Shares are held for at least 1 year after the Purchase Date.

- Shares are held for at least 2 years after the Grant Date.

If the employee sells the shares before meeting these requirements, the sale will be deemed a Disqualifying Disposition. This disqualifies the shares from preferential tax treatment, and thereby, taxation is similar to NQSOs where the value at Exercise Date is fully taxable as Ordinary Income.

In light of these tax discrepancies between Qualifying Dispositions and Disqualifying Dispositions, most employees plan on the former. While the corresponding tax benefits are enticing, it’s important to remember “there’s no free lunch”. By retaining the stock long enough the meet the Qualifying Disposition thresholds, the employee retains the single-stock risk. If the stock price declines, the employee’s desired tax savings could be more than offset by the stock decline.

There is one more layer of tax complexity with ISOs, which relates to the Alternative Minimum Tax (AMT). AMT is a parallel tax system designed to ensure high-income earners pay a baseline amount of tax, even if they have deductions or credits that would otherwise reduce total tax. While AMT applies to a very small percentage of individuals, exposure to ISOs can greatly increase the likelihood of AMT’s applicability. This is because ISO’s value upon exercise (“Bargain Element”) is an AMT preference item.

This can be a complex tax topic, but in short, the more ISO value realized upon exercise, the more likely AMT will be applicable. We work closely with individuals and their tax professionals to navigate this topic.

ISO Forfeiture

ISOs are contingent upon continued employment at the company. If an employee leaves the company, any unvested ISOs are forfeited. Employees have 90 days (or less) to exercise any vested ISOs following separation from service. After this 90 day period, any vested, unexercised ISOs will either be forfeited or convert to NQSOs (typically the former).

Mistakes Parable Can Help You Avoid

- Letting Valuable Options Expire: ISOs have an expiration date, and even “in the money” options become worthless if you don’t exercise them in time, especially post-separation when the clock ticks faster.

- Losing Value at Departure: Leaving the company means forfeiting unvested ISOs and just 90 days (maximum) to exercise vested ISOs. Missing this window—or not understanding your vesting schedule (cliff vs. graded)—can cost you significant value.

- Failing to Understand Qualifying Disposition Requirements & Benefits: Namely, knowing that BOTH holding thresholds (previously discussed) need to be met to receive favorable tax treatment.

- Failing to Balance Tax-Efficiency & Over-Concentration Risk: While the benefits of deferring sales until the Qualifying Disposition requirements have been met is often the right strategy, employees need to understand the risk of holding a concentrated single-stock position. In some situations, a Disqualifying Disposition could be more aligned with the individual’s goals & priorities.

- Failing to Capitalize on AMT “Free Amount”: In partnership with your tax professional, annually, we can quantify how much ISO value/Bargain Element can be realized without actually owing additional AMT.

A bigger story awaits. Make your equity compensation a part of it.

We believe every person can experience bigger possibilities for their life and finances. When true wealth becomes activated by purpose, equity compensation has a role to play in that story. We are passionate about helping you align who you are and what you’ve received in ways that will bring it to life at center stage.