Contributors: Ben Reynolds, Cuyler Prichard, Nathaniel Wisely,

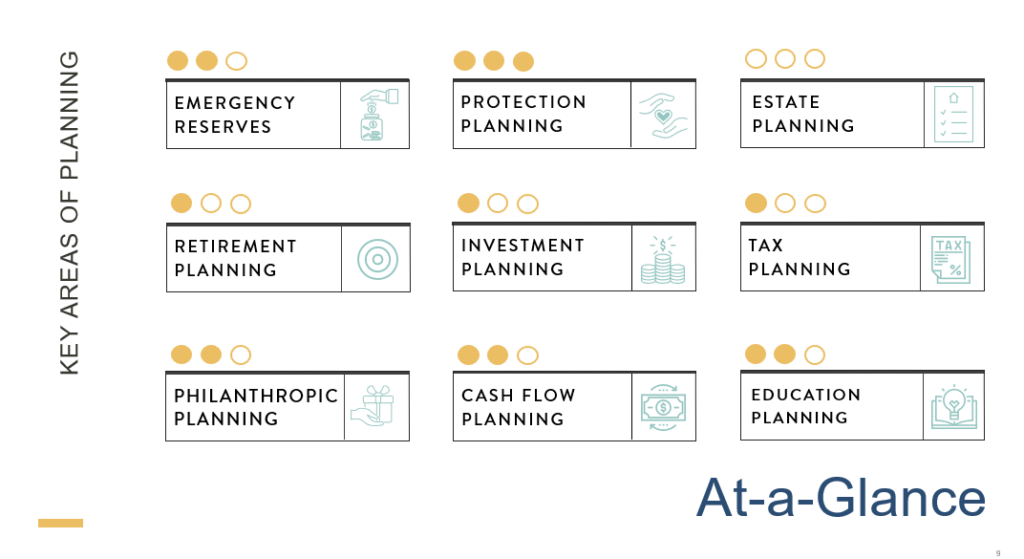

At Parable, we have the privilege of serving 160+ individuals and families in our formal Financial Planning process. Through this comprehensive process, we evaluate client’s financial health on various Key Areas of Planning, which is summarized on a personalized 9-Square tracker. The purpose of this 9-Square is to be a transparent and objective evaluation of one’s current position. This also helps Parable prioritize topics of greatest urgency for upcoming meetings.

Beyond the client-by-client benefits, we see great value in looking at the financial health data in aggregate across our entire client base of Financial Planning clients. This helps illuminate overall areas of strength and weakness for our clients. As lifetime learners, this leads Parable to look inward to consider “why are our clients systemically weak in this area of planning. Have we failed to sufficiently highlight the importance of this area of planning? How best can we reverse this trend moving forward to mitigate risks, capitalize on opportunities, and overall improve the financial health of our clients?”

Through this discernment process, estate planning has surfaced to the top as the most consistent area of weakness for our clients. This is unfortunate because estate planning is very important. If estate planning is done incorrectly, a client’s estate – which they have worked hard to build over a lifetime – could be in jeopardy of being misaligned with their original intent and desire.

Why don’t most Americans make Estate Planning a priority? A 2022 CNBC article stated 67% of Americans have no estate plan. Here is why:

- 40% said they haven’t gotten around to it.

- 33% said they don’t have enough assets.

- 13% said the estate planning process is too costly.

- 12% indicated they don’t know where to start.

To address these points head-on:

- Estate planning isn’t typically viewed as an urgent matter if a client feels that they are in a good place. Unfortunately, life is unpredictable and estate planning can quickly become an urgent matter. Clients that have gone through the estate planning process have stated that they are more confident and content with their financial plan. They enjoy the feeling of peace that comes with having their “ducks in a row”.

- Our team highly encourages that all clients prioritize having updated estate documents in place. While it’s true that some cases are more complex than others, what’s consistent is the desire to influence how one’s estate is distributed upon death.

- The upfront cost of the estate planning process can range substantially (typically $1,000 – $7,500 depending on complexity), but when you take into consideration the typical administrative cost of probate to be 2% of your estate, the upfront cost starts to look very inexpensive.

- Good news – we can help provide a list of great referrals! Our estate planning attorneys have a wealth of knowledge that greatly benefits the clients of Parable. Please reach out to us at team@parablewealth.com, or you can give us a call at (952) 475-9700 for any questions and/or more information.

Our team here at Parable wants to help you prioritize estate planning in 2023. We recommend partnering with an estate planning attorney to ensure you have key documents in place. This includes Wills, Health Care Directives, Power of Attorney documents, and potentially others such as Trust documents. Our team has curated a list of wise professionals that we greatly trust and would be happy to help you connect with to start your estate planning journey.

Although up-to-date estate planning documents may not be high on your to do list, our team would like to encourage you reconsider this so that you may step forward into hope and contentment with your finances.

Investment advisory services offered through Thrivent Advisor Network, LLC., a registered investment adviser and a subsidiary of Thrivent. Advisory Persons of Thrivent provide advisory services under a “doing business as” name or may have their own legal business entities. However, advisory services are engaged exclusively through Thrivent Advisor Network, LLC, a registered investment adviser. Parable Wealth Partners and Thrivent Advisor Network, LLC are not affiliated companies. Information in this message is for the intended recipient[s] only. Please visit our website parablewealth.com for important disclosures.

Investment advisory services offered through Thrivent Advisor Network, LLC., (herein referred to as “Thrivent”), a registered investment adviser. Clients will separately engage an unaffiliated broker-dealer or custodian to safeguard their investment advisory assets. Review the Thrivent Advisor Network Client Relationship Summary, Financial Planning and Consulting Services, Investment Management Services (Non-Wrap) and Wrap-Fee Program brochures for a full description of services, fees and expenses, available at Thriventadvisornetwork.com. Thrivent Advisor Network, LLC’s Advisory Persons may also be registered representatives of a broker-dealer to offer securities products.

Advisory Persons of Thrivent provide advisory services under a “doing business as” name or may have their own legal business entities. However, advisory services are engaged exclusively through Thrivent Advisor Network, LLC, a registered investment adviser. Parable Wealth Partners and Thrivent Advisor Network, LLC are not affiliated companies. Information in this message is for the intended recipient[s] only. Please visit our website www.parablewealth.com for important disclosures.

This Report does not provide legal, tax, or accounting advice. Before making decisions with legal, tax, or accounting ramifications, you should consult appropriate professionals for advice that is specific to your situation. Advisor is not a licensed attorney and legal advice is not part of any engagement for financial planning or estate planning services.

Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable.

Asset allocation may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss. Performance of the asset allocation strategies depends on the underlying investments.

We will provide all prospective clients with a copy of our current Form ADV, Part 2A (“Disclosure Brochure”) and the Brochure Supplement for each advisory person supporting a particular client. You may obtain a copy of these disclosures on the SEC website at http://adviserinfo.sec.gov or you may Contact us at team@parablewealth.com to request a free copy via .pdf or hardcopy.