Contributors: Andrew Walker, Bruce Ensrud, Matt Stockman

Asset Class Deep Dive

Recent market volatility has hit stocks and bonds nearly equally hard, with both down about 10% at the time of this writing[1]. Normally bonds are incredibly resilient during times of market and economic stress, so what is going on, and what can we do about it? Should I even own bonds anymore?

[1] Using the S&P 500 Index to represent stocks and the Bloomberg Barclays US Aggregate Bond Index to represent bonds.

What’s happening right now?

In short, inflationary forces, along with the Federal Reserve acting in response to these forces, have pushed rates up, causing bond prices to go down.

Heading into 2022, broken supply chains, reopening economies, and residual effects of enormous COVID-era stimulus were causing inflation to heat up. Because interest rates go up and down based on expectations around inflation and economic growth (in this case, inflation), interest rates were steadily rising as well. What really fueled the rise in rates, however, was the Federal Reserve signaling that it would be more aggressive in fighting inflation by doing MORE rate hikes at a FASTER pace than previously anticipated. Of course, Russia’s invasion of Ukraine in February also materially contributed to the global inflationary backdrop.

What can we do about it?

In short, there is plenty that can be done!

Just like the stock market, the bond market is very nuanced and complex. In fact, many are surprised to know that the bond market is much bigger than the stock market. Like the stock market, then, there are always relative opportunities to be uncovered within different corners of the bond market. Some of these “corners” include geography, bond quality, bond maturities, sectors, and more. Also like the stock market, there are various strategies that can be employed when investing across different parts of the market. All this to say, today’s low yield environment simply requires a higher level of analysis and creativity when building bond portfolios.

In managing bond portfolios, we have been focusing on three key value-add strategies:

- Overweight short maturity bonds, as these are less sensitive to rising interest rates when compared to intermediate and longer maturity bonds.

- Focus on bonds from high quality companies, given the tremendous amount of economic uncertainty that COVID has injected into the world.

- Utilize ‘bond alternatives’, which we define as assets that are uncorrelated to stocks with a similar volatility profile to bonds. Not only do these investments present much more attractive return opportunities than traditional bonds, but they have little interest rate risk, which is beneficial in a rising interest rate environment.

The strategies discussed above have proven to be beneficial to our portfolio thus far this year, and have insulated our portfolio well (though certainly not completely) from rising interest rates.

Should I even own bonds anymore?

Constructing a well-diversified portfolio is a critical component to our risk management process. This requires combining assets that are uncorrelated with one another. While the return prospects of bonds are not as appealing when compared to history, they still demonstrate the ability to reduce risk within an overall portfolio – even though bonds occasionally trade down like stocks, creating doubts as to their ability to protect capital.

Beyond this, an active approach to managing a bond portfolio, as highlighted above, has the potential to mitigate volatility when compared to the broader bond market.

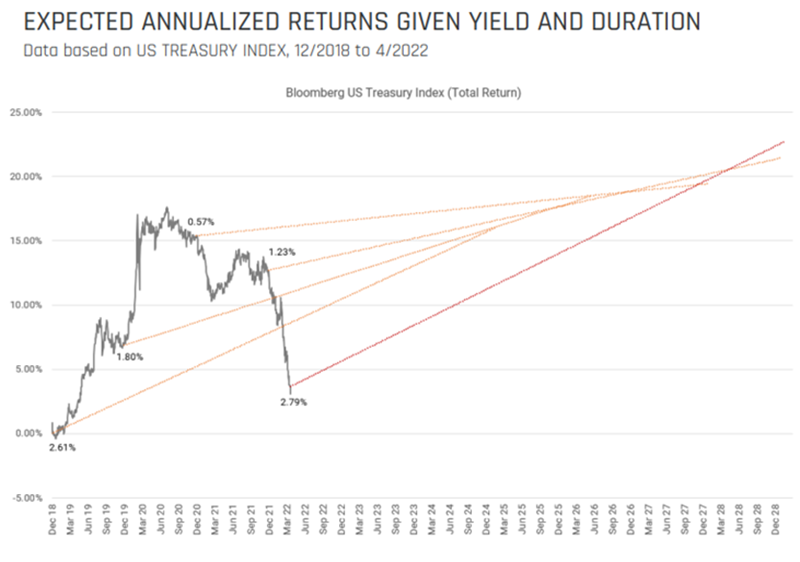

The silver lining of rising interest rates is that interest income is reinvested at more attractive levels. Unlike stocks, bonds are mathematical instruments and future returns are much more predictable (not completely predictable by any means) than stocks. While the price of bonds has fallen, reinvesting into higher yielding investments should eventually cause investors to be made whole and increase the yield on their portfolio over time. As the above graph shows, as bond values fall, the expected annualized return increases thanks to rising interest rates. In fact, a common rule of thumb is that the forward looking 5 year annualized return of a bond – all else held constant – will be close to the starting yield today. This reflects the benefit of reinvesting interest income into today’s higher interest rates.